20 Interesting Financial Facts About Google

All of Google’s employees are also equityholders.

Google invested $3.8 billion in research and development in 2010 and represents their largest indirect expense.

The combined shareholdings of Larry Page, Sergey Brin and Eric Schmidt represented 67% of the voting power of the company at the end of 2010. This is achieved through their ownership in a different class of stock which provides for a greater number of votes.

PRODUCTS AND SERVICES

Google’s provides products and services in more than 100 languages to more than 50 countries. The US still accounts for the most significant portion of their business at 48%, while the UK accounts for about 11%.

They note that Internet usage is much lower in the summer month, while highest internet usage is in the last quarter of the year.

Their competition includes Facebook, Bing, Amazon,Ebay, Twitter, Monster, all types of advertising and providers of online products and services.

REVENUES AND EXPENSES

Gross revenues from 2006 to 2010 were:

Revenues have increased almost tenfold since 2004.

Net income after taxes was $8.5billion, representing a 30% net profit margin.

Approximately 96% of their revenues came from Advertising. This is essentially unchanged from previous years. This is an area of weakness from Google as any changes to the internet advertising market could have a significant impact on their revenues.

Combined Income taxes expense, in various jurisdictions, totalled 21% of their net income.

Cost of revenues i.e. the direct costs of sales included amounts paid to adsense members as well as operation of data centres and amounted to $10.4 Billion.

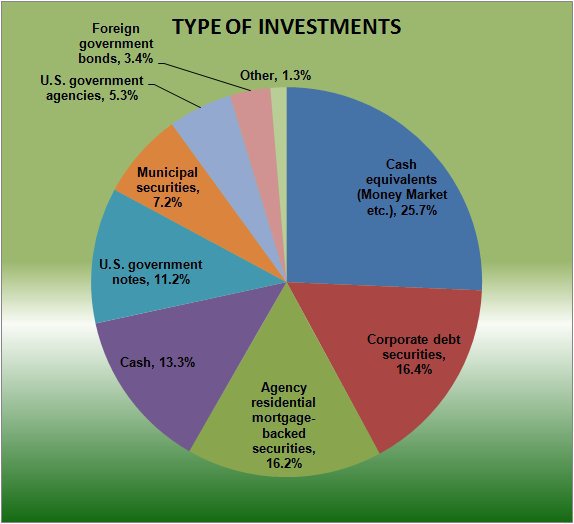

CASH AND INVESTMENTS

Google held $34 billion in cash and marketable securities at the end of 2010

They earned $346 million in investment income in 2010.

As of December 31, 2010, $16.7 billion of the $35.0 billion of cash, cash equivalents, and marketable securities was held by foreign subsidiaries. Google notes that if these funds are needed for operations in the U.S., they would be required to accrue and pay U.S. taxes to repatriate these funds, although they do not expect to need the funds.

Since Google is not an investment company, it should be noted that they appear to have an excessive amount of cash. Their net return in 2010 was approximately 1% of their ending cash balance, significantly and negatively affects their overall return.

ACQUISITIONS

In December 2010, Google completed an acquisition of an office building in New York City for total cash consideration of $1.8 billion

Major business acquisitions during 2010 included:

During the year ended December 31, 2010, 44 other acquisitions for a total cash consideration of approximately $669 million were made.

This is a strategy that has worked very well for Google in the past and is a good use of excess cash. It also represents their commitment to expanding their product and service offerings.

It will be exciting to see how Google continues to perform in the face of significant competition (Facebook, Microsoft, Apple), changes in leadership (Larry Page replacing Eric Schmidt as CEO) and the numerous risks that are inherent for an internet and technology company.

Related Articles: