Should You Transition to a Paperless Office (and What CRA Has to Say about It)

Imagine having an office without clutter, free from sad looking boxes and filing cabinets filled to the brim, where you don’t have to rifle through unlabeled containers to find a receipt for a computer that you bought three years ago. . An office where you can make Marie Kondo proud by getting rid of (almost) anything that does not bring you joy and surrounding it instead with items that inspire (or at least improve productivity). This is all possible with a few apps, sufficient digital space and a shift in your mindset and processes.

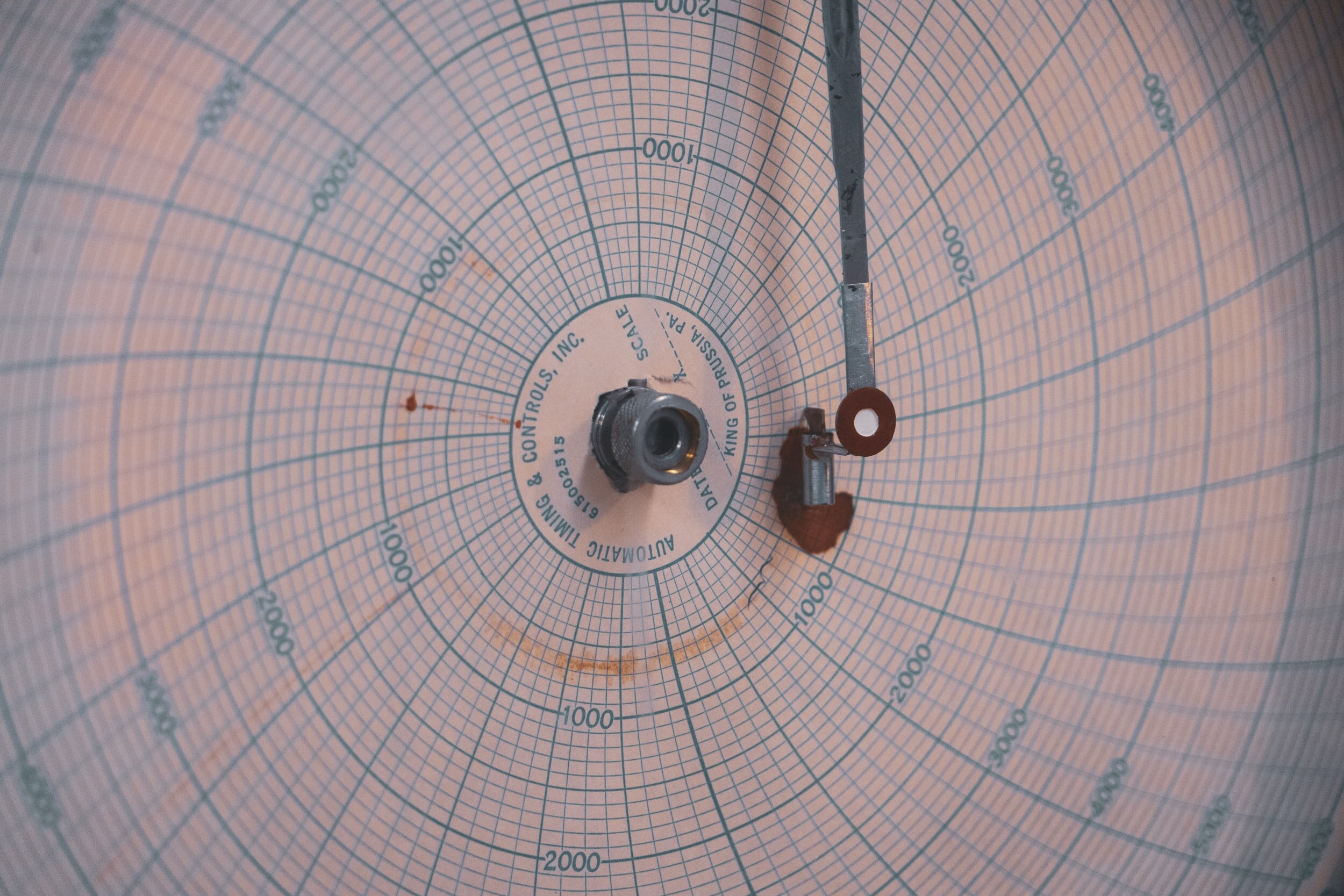

How to customize a Chart of Accounts for optimal financial reporting

A chart of accounts is the structural framework for any business accounting system. It is analogous to a filing system. If you wanted to, you could dump all your documents into one giant file in your filing cabinet (or a file folder on your computer). Of course, if you did do it this way, you would likely have a hard time locating your documents. Alternatively, you could create a series of folders, based on an organization system that makes sense for you and your business. This type of structure would make it much easier and (as long as you remember your system), much more efficient to find what you are looking for. The more precise your system, the more time you save and the easier your documents become to access. Similarly, a chart of accounts is a type of categorization arrangement for your financial data. You slot everything into a category with the ultimate goal of getting financial reports such as your balance sheet and profit-loss statement that provides valuable info to the business owner as well as the other other stakeholders of the business. It should be noted that while each chart of accounts has commonalities and some specific conventions that should be followed, there is no one size fits all. Consequently, it is important to spend some time thinking about a chart of accounts that fits the profile of your business. If you are using Quickbooks Online, you can read this in conjunction with our article on setting up QBO for the first time and watch my video on working with chart of accounts in QuickBooks Online.

How to Account for Bad Debts and Record it in Quickbooks Online and Desktop

One of the more unpleasant aspects of being a business owner is having to chase clients that do not pay. It is frustrating, stressful and disheartening, while attempts to collect are an unproductive use of time and can have a significant impact on cash flow, particularly if you are unprepared. A bad debt, in accounting terms, refers to an amount charged to a customer that is never paid. While the original sale would have been reflected as revenue, the uncollectible bad debt would then have to be written off as a separate line item on the profit and loss statement

How To Close Your Year End (or Period End)in QBO

Doing your own accounting in accounting software such as QuickBooks Online (QBO) is relatively straightforward especially if you have set up your QBO file optimally. You periodically enter invoices, expenses, bills and allocate transactions from the banking download. And while QBO is designed for non accountants, it is also equally appreciated by many accountants for its simplicity and user friendliness (although, as with any software product, there are grievances).

There does come a point, however, when you might notice that some things don’t look right. The bank balance or credit card balance might not match to the QuickBooks balance or your income and/or expenses might seem much too high or inconsistent with previous years. The solution to identifying and fixing these discrepancies is to perform what accountants refer to as year end (or month end) closing procedures, that if done properly, should correct any discrepancies that crop up. The ultimate goal of closing the books monthly or annually is to ensure that you can rely on the integrity of your data.

How to determine if your business idea Is profitable

I have spoken to and mentored many lovely entrepreneurs who have wonderfully innovative ideas for a new business. But, as any business owner can attest to, starting a new business is hard work. Before even thinking about launching, you need to ensure that the business is actually viable. You do this by assessing your market, reviewing potential demand for your product and analyzing the competition. Once you have done this, you then need to ensure that your business can be profitable.

In order to determine profitability, you need to understand both the pricing of your products and/or services and the relevant costs. This can be difficult to do especially when you don’t have any history. Your only choice is to estimate based on the best information available. In this article, I give you some guidance on the financial information that you need to compile.

Improve Your Small Business Cash Flow with These 10 Tips

One of the biggest challenges for many small business owners, particularly in the initial and growth stage, is ensuring that they maintain sufficient cash flow. Many businesses with great potential have suffered an untimely demise due to their inability to pay their suppliers, employees and revenue agencies. In many cases, this can be prevented through a better understanding of your small business’ cash flow requirements and making sure that you implement relevant processes that can handle cash flow issues as they arise.

What Are Bank Reconciliations and Why Every Business Should Do Them

Many small business and self employed owners take on the responsibility of doing their own accounting. You may do all of your own accounting from set up to preparing your own small business tax return OR you may have an accountant who simply takes care of your year end and tax reporting. Accounting software has made doing your own accounting much simpler and allows for most business owners to do it, regardless of whether they have some sort of accounting background. There is however a learning curve and certain accounting steps that not everyone is aware of and that are very important to ensure the accuracy of your books. One of these is are bank reconciliations.

18 Accounting Terms that every new business owner should know.

When starting a new business, you will be subjected to a variety of financial jargon. This can come from your bank, Revenue Canada or Revenue Quebec, suppliers, customers and various other business partners. If you are unfamiliar with this terminology, these requests which are often quite straightforward, can become stressful if you are not exactly sure what they mean. It is important, therefore, to arm yourself with at least a basic vocabulary of the most common financial and accounting terminology that will give you a better understanding of your business and therefore be well equipped to answer any questions that come your way.

4 Simple Financial Metrics to Help Measure the Success of Your Small Business

Most small business owners want insights into their business performance to get a sense of what they are doing well while also trying to understand their areas of weakness. Unfortunately a big picture view does not always immediately reveal itself– a thorough understanding of your business generally requires a more thorough analysis and introspection. You may be tempted to look at cash (or lack thereof) in your bank account or your net profit , however these are not always reliable indicators of success or failure , particularly when taken in isolation. Every small business owner should identify the specific needs and constraints of their business to determine the optimal analysis required to assess its financial performance. Some general analysis that most businesses can benefit from are presented below:

Top 6 Signs Your Small Business Might Need a New Accountant

I met with a small business owner recently who had just purchased a retail business and was looking for a new accountant. It seems that the current accountant was reviewing her books on a quarterly basis, preparing financial statements and doing the year-end tax returns – all typical accountant stuff. The problem was that the accountant, while charging this small business a fairly significant amount of money, was not really adding any value to their business. The bookkeeping, which was done by the previous business owner, was still being entered manually in ledgers (!). The quarterly accounting review consisted of checking the ledgers for mathematical accuracy and ensuring no major deductions had been missed without any discussion regarding the performance of the business. Worst of all, the accountant was not responding to the client’s requests for a meeting to discuss the financial performance of the business

Why a Separate Bank Account is Essential for Your Small Business

If you are self employed or a small business owner taking care of your own accounting and business finances, you have probably discovered that this can be time consuming and occasionally frustrating. It can sometimes be difficult to know if you are doing things correctly. Consequently, you procrastinate, which makes things worse at year end or tax time. To combat the problem it is important to have tools in place to facilitate the process and make it less painful, which could include accounting software and/or a bookkeeper as well as a good organization system for your documents, whether you have a paperless office or a manual filing system. Another very simple measure that you can take is to have a separate bank and credit card account for your business.

19 Features to Consider When Selecting Small Business Accounting Software

A good accounting software can be an invaluable tool for businesses. Before choosing an accounting software it helps to have a detailed understanding of what your accounting system can do for you . This involves analysing the key aspects of your business, determining what is essential (eg. invoicing, expenses, banking, reports) and what you would like to have (eg. time tracking, credit card payments, banking downloads etc.). By reviewing your requirements in advance and building a checklist, you can make a better decision about something that goes to the very foundation of your business. Below are some important features to consider:

3 Online Accounting Software Options for Small Business

As cloud computing becomes ubiquitous, the number of cloud based online accounting software options continues to grow. Many small business owners want a software that has an intuitive and easy-to-use interface that allows them to bill customers, enter expenses, record bank transactions and generate financial statements and other reports,. We also want to be able to access the software from anywhere (you never know when the desire to do your accounting strikes!) and not be tied down to a specific location Below is a summary of 3 cost effective, multi functional alternatives :

How to Prepare a Business Budget

One of the primary challenges facing a small business owner is uncertainty about the future. (It is also what makes entrepreneurship exciting). We may have an amazing product or service, but we can’t be sure whether this will actually translate into a profitable business model. A budget is an excellent tool to manage uncertainty and, contrary to popular belief, can actually be fairly straightforward to prepare, particularly for small businesses that do not have to worry about different departments, product lines and geographic areas .

A budget, very simply, is a tool that helps you predict your sales, expenses and profitability as well as your cash flow needs. It is based on estimates, which in turn are based on a combination of experience, history and industry knowledge. In terms of presentation, a budget should essentially mirror your financial statements and will include the following main categories: