Two (and a Half) Options for Claiming Employee Home Office Expenses in 2020

As numerous employees shifted from their offices to their homes, Revenue Canada (CRA) and accountants were deluged with questions about how they could claim home office expenses. To stave off the complaints and questions, CRA decided to introduce a simplified method of claiming a tax deduction. It should be noted that employees have always been allowed to claim expenses relating to their employment as long as their employers completed and signed form T2200. The information from this form would then be entered on Schedule T777. The issue for this year is that filling out the form and completing the schedule is a somewhat tedious process and does not fit all employees’ who worked from home as a result of Covid imposed restrictions.

COVID-19 Details on Canada 75% Wage Subsidy for Businesses with Employees (CEWS)

Businesses who have employees that are on payroll (i.e. for whom deductions at source is being remitted and T4s/RL1s are being issued) are entitled to a Wage Subsidy of 75% of the employees’ gross payroll up to a maximum of $847 per week referred to as Canadian Emergency Wage Subsidy or CEWS. This should prove to be very helpful to businesses who don’t want to let employees go but due to reductions (or complete stoppage) of revenues may not be able to afford to pay them. It provides for business continuity and financial relief to a significant subsection of the population.

COVID-19: Financial and Tax Relief Measures for Small Business and Individuals (UPDATED)

UPDATED APRIL 27, 2020

In response to the financial pressure being felt by small business, employees and individuals as a result of COVID-19, a number of measures have been announced by governments and banks to alleviate this difficulty These are enumerated in this post and while details relating to eligibility, how to apply etc. on the measures announced by the federal government today are still forthcoming, small businesses and individuals now know what types of financial relief they may be eligible for and can start preparing accordingly.

Impact of COVID-19 on Small Business and Their Employees(UPDATED): EI Sickness and EI Regular Benefits

Updated on March 30, 2020 for CERB which will replace the EI benefits in the short term.

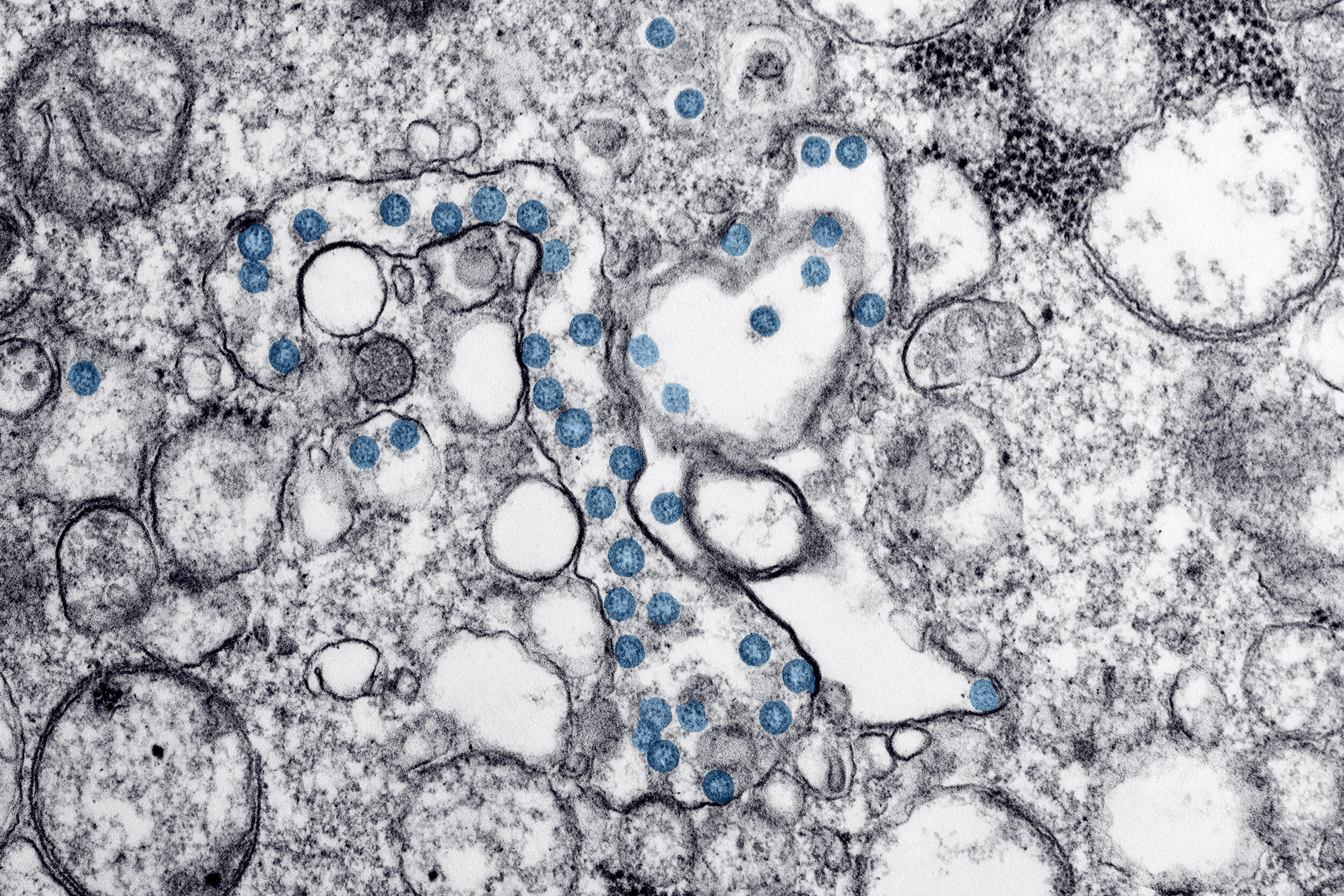

The impact of Covid 19 (caused by the CoronaVirus) is being felt deeply all across the world right now as individuals, businesses, healthcare institutions and governments try to cope with the ongoing and evolving implications. It is a difficult time as individuals try not to panic and governments are endeavouring to decide the best course of action for their citizens. Small businesses are experiencing are experiencing dramatic slowdowns or are being forced to close as customers stay at home.

Businesses who have employees that are quarantining themselves due travel or potential contact with the Coronavirus as well as employees who are laid off are entitled to EI Benefits. While there have been some changes to the sickness benefits in the face of Covid 19, EI benefits currently remain the same and are explained below:

Employment Insurance for Small Business Owners and Self Employed Individuals

One of the benefits allowed employees working in Canada is that have access to employment insurance. A specific amount is withdrawn from each employees paycheques each pay period along with an employer portion and remitted to Revenue Canada. This entitles them to wage loss replacement, in the event that they are laid off, as well as other benefits. This can be extremely useful in difficult times and has been used by millions of Canadians.

Unfortunately, taxpayers who are considered self employed are not entitled to the same benefits. A self employed individual also includes anyone who owns 40% of a corporation and usually extends to family members of self employed people. By the same token, self employed taxpayers (whether they are sole proprietorships or owners of corporations) are also not required to pay employment insurance (EI) premiums.