Explore Small Business Finance Topics

Discover our most popular topics for Canadian solopreneurs and small business owners. From income tax and GST/HST to QuickBooks tutorials and managing your business finances, these guides are designed to help you move from financial uncertainty to financial confidence.

Click on any topic and scroll down to see related articles.

📑Canadian Income Tax

Guidance on filing and planning your Canadian taxes, from T1 and T2 returns to instalments

📊Managing Business Finances

From cash flow to pricing and metrics — learn to manage your business finances with confidence.

🏢 Canadian Business Structure

Should you incorporate? Stay informed on sole proprietorships, corporations, and registrations.

💰 GST/HST & QST

Understand how to register, file, and maximize input tax credits while avoiding common mistakes.

🧾 Guides and Tutorials

Practical accounting processes like reconciliations, journal entries, and reporting.

📝 Deductions & Expenses

Learn which expenses are CRA deductible and how to track them for maximum tax savings.

Quebec Taxes & Business

QST, Revenu Québec filings, Quebec payroll, and provincial rules every entrepreneur should know.

👤 Paying Yourself

Salary vs dividends, management fees, and how to pay yourself from your corporation or small business.

💻 QuickBooks Online & Tools

Tutorials, guides and time-saving tips for using QuickBooks Online effectively.

🏦 Money & Personal Finance

Personal finance strategies for entrepreneurs, from RRSPs to saving for taxes.

COVID-19: Financial and Tax Relief Measures for Small Business and Individuals (UPDATED)

UPDATED APRIL 27, 2020

In response to the financial pressure being felt by small business, employees and individuals as a result of COVID-19, a number of measures have been announced by governments and banks to alleviate this difficulty These are enumerated in this post and while details relating to eligibility, how to apply etc. on the measures announced by the federal government today are still forthcoming, small businesses and individuals now know what types of financial relief they may be eligible for and can start preparing accordingly.

Tips and Tools for Working from Home

Having a home based business has many advantages - there's no wearying commute to and from work, our sleep schedule is not beholden to an alarm clock and it allows us to work, if we so choose, when we are at our most productive or creative. An additional benefit is that expenses relating to our home office are tax deductible. Working from home can, however, also present a unique set of challenges. Given the proximity of distractions including our beds, fridges , tvs and perhaps worst of all, our computers, it requires a great deal of discipline and focus to actually get any work done.

Small Business Tax Filing Deadlines for 2019 (UPDATED)

As the year end approaches, small businesses should be aware of the deadlines, imposed by Revenue Canada and Revenue Quebec, for their various tax obligations. Ensuring that these are done on a timely basis can result in significant savings , that can be put to better use in the business , by avoiding interest and penalties. It also helps to prevent aggressive notices from revenue agencies and reduces the red flags that tend to accompany habitually late filers. Below are the deadlines that businesses should be aware of:

Impact of COVID-19 on Small Business and Their Employees(UPDATED): EI Sickness and EI Regular Benefits

Updated on March 30, 2020 for CERB which will replace the EI benefits in the short term.

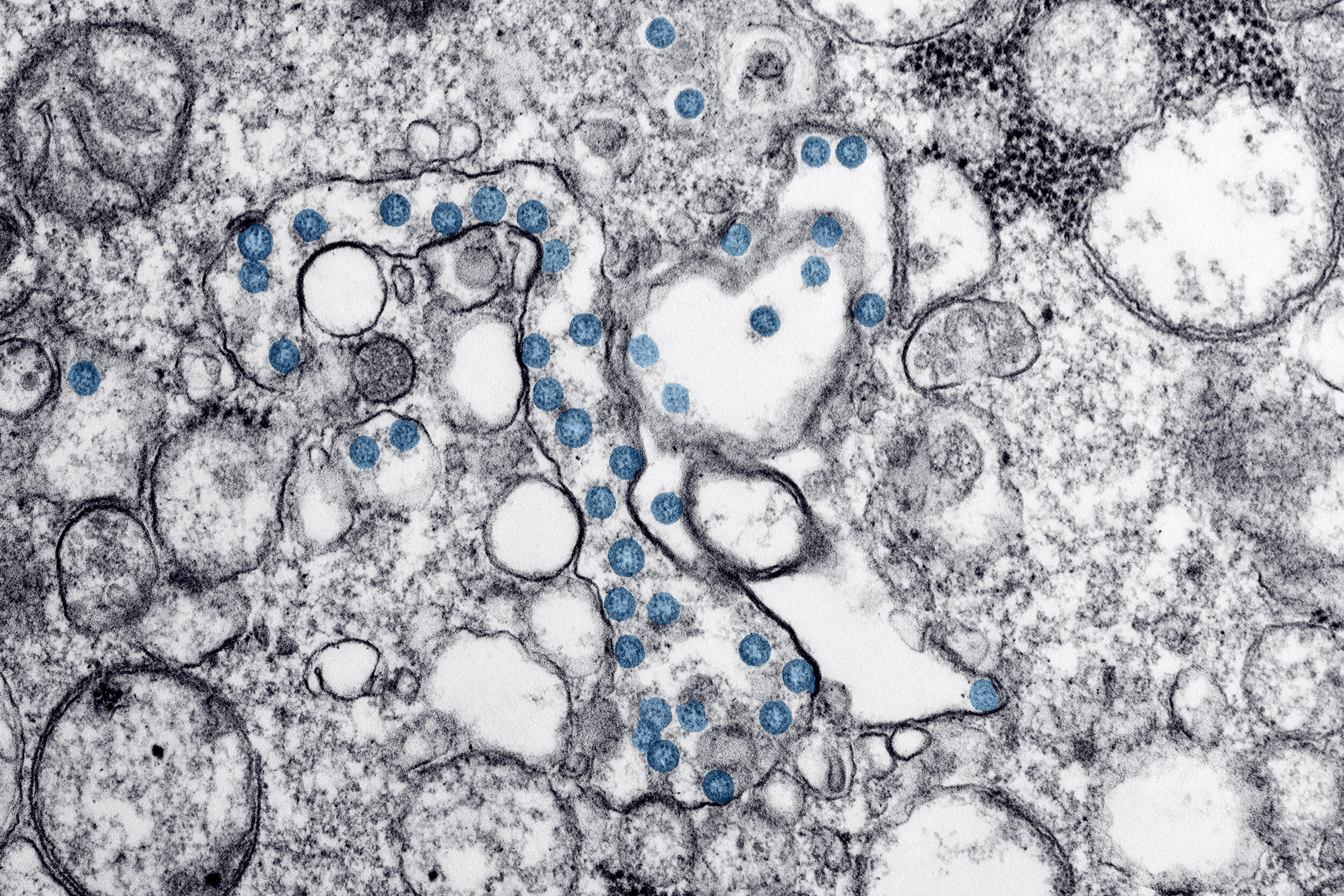

The impact of Covid 19 (caused by the CoronaVirus) is being felt deeply all across the world right now as individuals, businesses, healthcare institutions and governments try to cope with the ongoing and evolving implications. It is a difficult time as individuals try not to panic and governments are endeavouring to decide the best course of action for their citizens. Small businesses are experiencing are experiencing dramatic slowdowns or are being forced to close as customers stay at home.

Businesses who have employees that are quarantining themselves due travel or potential contact with the Coronavirus as well as employees who are laid off are entitled to EI Benefits. While there have been some changes to the sickness benefits in the face of Covid 19, EI benefits currently remain the same and are explained below:

3 Online Accounting Software Options for Small Business

As cloud computing becomes ubiquitous, the number of cloud based online accounting software options continues to grow. Many small business owners want a software that has an intuitive and easy-to-use interface that allows them to bill customers, enter expenses, record bank transactions and generate financial statements and other reports,. We also want to be able to access the software from anywhere (you never know when the desire to do your accounting strikes!) and not be tied down to a specific location Below is a summary of 3 cost effective, multi functional alternatives :

Business and Tax Implications of Owning Rental Property

A great many fortunes have been made in real estate. Conversely, as was evidenced in 2008 with the deflation of the housing bubble, many fortunes have also been spectacularly lost. Fortunes aside, owning real estate is one of the best ways to build equity. If you own your home, you are already one step ahead. With rental property, you can further augment your net worth if after investing the necessary down payment the rental income covers and/or exceeds the mortgage payment and related expenses, (Leaving you free to move on to buying your next property). This is not a decision to take lightly as with any investment there are several business and tax factors to consider before taking the plunge:

What is your Net Worth?

There comes a point in many people's lives when they want to find out what they are worth. This is much more difficult to quantify on a metaphysical level; however on a tangible level most people can figure out how much wealth they have created over time. The definition of net worth is simply the total of all your assets (what you own) less your liabilities (what you owe).

Employment Insurance for Small Business Owners and Self Employed Individuals

One of the benefits allowed employees working in Canada is that have access to employment insurance. A specific amount is withdrawn from each employees paycheques each pay period along with an employer portion and remitted to Revenue Canada. This entitles them to wage loss replacement, in the event that they are laid off, as well as other benefits. This can be extremely useful in difficult times and has been used by millions of Canadians.

Unfortunately, taxpayers who are considered self employed are not entitled to the same benefits. A self employed individual also includes anyone who owns 40% of a corporation and usually extends to family members of self employed people. By the same token, self employed taxpayers (whether they are sole proprietorships or owners of corporations) are also not required to pay employment insurance (EI) premiums.

Quebec’s Small Business Tax Deduction and How It Relates to Payroll Hours

Revenue Quebec, in the March 2017 budget (or economic plan as they like to call it) decided that a small business wasn’t a small business for the purposes of the tax deduction, unless a minimum number of payroll hours was worked by employees of the business. Initially they had wanted to impose a minimum number of 3 full time employees to qualify for the deduction, however, after realizing that many businesses had several part time employees during the year, they changed the requirement to a minimum number of hours worked to 5,500 hours per year. This could be a combination of full time and part time employees. Consequently, many businesses that had qualified for the small business tax rate were no longer eligible.

Employee vs. Self Employed: Criteria and Considerations

For the majority of income earners, employment status is pretty evident. If you are going to the same place every day, have an assigned cubicle with a computer and a corporate stapler, and you have a boss that tells you what you need to do, chances are you are an employee. Conversely if you have several clients, use your own laptop, and are worried about where your next sale is going to come from, you are probably self employed.

There are, however, some workers whose status is not that apparent. For example you may work from home and use your own computer, but you report to one entity, where someone supervises and directs your work. In these cases a determination needs to be made as to whether you are an employee or self employed. It is not enough for the person paying you to determine your classification ; often, payers are biased as they may not want to take on the financial costs and responsibilities of having an employee (explained below). As such, when in doubt about your status, it is helpful to answer the following questions:

The Importance of Breakeven Analysis for Business Owners

When embarking on your new business venture, one of the first and most important concepts that you will be introduced to is break-even analysis which, very simply, is the amount of revenues you need to generate to cover your direct and indirect expenses. A good grasp of this is essential for business owners since even businesses with significant sales revenues can incur losses if they are not able to cover their costs. While break even analysis tends to be used more for businesses that sell physical products, it can also help to the determine the price for services

24 Cost Effective Ways to Promote Your Small Business

After thinking long and hard you have decided that is time to launch your own business. You have a great product or service, you’ve come up with a compelling business name, all the paperwork has been filed and you have picked out the perfect location (or setup a snazzy new home office). All pieces are in place for your new independent life as a business owner. And then you realize that nobody except your spouse, family members and possibly your cat knows about your new venture. So, how do you bring your fabulous new product or service to your target market's attention? One way is to use the “build it and they will come” approach. This is usually not particularly effective (even Google, who historically launches products with little fanfare, could benefit from a little more marketing). The other, more effective approach is to get out there and promote your business. Of course in the initial stages, marketing budgets tend to be minuscule. On the other hand, many new business owners have time on their hands, while they wait to be deluged by orders. Below is a list of 24 cost effective ways to promote your small business:

What Is a Capital Dividend and How Does It Benefit Your Corporation

When an individual sells some property, investments or other assets (perhaps you have a Picasso lying around that's appreciated in value), only 50% of the gain is subject to tax. For example if you sell a rental property and realize a gain, after brokerage and expenses, of $100,000, only $50,000 will be taxable. (The actual tax that you pay will depend on your marginal tax rate at the time). The other 50% of the capital gain is a non taxable gain. For a corporation, however, this distinction is a little more complex. In order to allow corporations the same benefit as individuals with respect to capital gains and losses, the 50% non taxable portion of the gain on a corporate capital transaction is allocated to what is referred to as a Capital Dividend Account or CDA. The balance in the CDA, which is a cumulative balance over the lifetime of a corporation, is then available to the shareholders on a tax free basis.

Investment Strategies for Your Incorporated Small Business

One of the benefits of having an incorporated small business is that after paying yourself a salary or dividend any excess funds can be invested directly through the corporation. Since small businesses often cannot predict how their business will perform from year to year, the ability to retain funds in the corporation allows for a cushion to smooth out fluctuations in earnings which can then be paid out in lower performing years. By keeping the funds in the corporation, the business is able to defer tax since usually the small business tax rate is lower than the personal tax rate. Some points to consider:

How to Set Up a Small Business Accounting System

Many small business owners (myself included) tend to focus on the more glamourous aspects of their business eg. sales, marketing and product/service development. As a result, accounting often does not get the attention it deserves. In addition to the perception that an accounting system does not necessarily add value, it can also be a little intimidating. However, there are numerous benefits to setting up an accounting system and it can actually be fairly straightforward especially if you have some help with setting it up. A good accounting software tends to handle most of the complexity of accounting as long as the data is compiled and entered accurately.