4 Factors to Consider When Pricing Your Small Business Services

One of the most challenging aspects of starting and maintaining a business, regardless of whether you are a freelancer or a conglomerate, is determining the right price to charge for your services. If you are an economist, the ideal price is simply the point at which demand meets supply. If a price is too high the demand for the service will go down thereby resulting in excess supply or capacity by the service provider. If the price is too low then demand will increasing leaving the supplier less availability to meet demand. Of course, pricing can be significantly more complex than this and has become a lot more sophisticated in recent years. Businesses pay thousands of dollars to pricing consultants for strategies that take numerous factors into consideration when determining pricing. One only has to look to airlines as example of a seemingly inscrutable pricing model. Unfortunately, smaller businesses, freelancers and startups don’t usually have the budget for a pricing strategist and have to make do by searching for information available on the internet, discussing it with their business associates or simply using their gut to come up with something that makes sense. As an internet source, I have set out a strategy for determining a price for your services

Tips and Tools for Working from Home

Having a home based business has many advantages - there's no wearying commute to and from work, our sleep schedule is not beholden to an alarm clock and it allows us to work, if we so choose, when we are at our most productive or creative. An additional benefit is that expenses relating to our home office are tax deductible. Working from home can, however, also present a unique set of challenges. Given the proximity of distractions including our beds, fridges , tvs and perhaps worst of all, our computers, it requires a great deal of discipline and focus to actually get any work done.

3 Online Accounting Software Options for Small Business

As cloud computing becomes ubiquitous, the number of cloud based online accounting software options continues to grow. Many small business owners want a software that has an intuitive and easy-to-use interface that allows them to bill customers, enter expenses, record bank transactions and generate financial statements and other reports,. We also want to be able to access the software from anywhere (you never know when the desire to do your accounting strikes!) and not be tied down to a specific location Below is a summary of 3 cost effective, multi functional alternatives :

What is your Net Worth?

There comes a point in many people's lives when they want to find out what they are worth. This is much more difficult to quantify on a metaphysical level; however on a tangible level most people can figure out how much wealth they have created over time. The definition of net worth is simply the total of all your assets (what you own) less your liabilities (what you owe).

Employment Insurance for Small Business Owners and Self Employed Individuals

One of the benefits allowed employees working in Canada is that have access to employment insurance. A specific amount is withdrawn from each employees paycheques each pay period along with an employer portion and remitted to Revenue Canada. This entitles them to wage loss replacement, in the event that they are laid off, as well as other benefits. This can be extremely useful in difficult times and has been used by millions of Canadians.

Unfortunately, taxpayers who are considered self employed are not entitled to the same benefits. A self employed individual also includes anyone who owns 40% of a corporation and usually extends to family members of self employed people. By the same token, self employed taxpayers (whether they are sole proprietorships or owners of corporations) are also not required to pay employment insurance (EI) premiums.

Pros and Cons of Incorporating your small business

The decision to incorporate can be a difficult one that many small businesses face at some point in their lifetime and . Incorporation, literally, represents the creation of a new person. Whereas a sole proprietorship is an extension of one's self, a corporation takes on a life of it's own; it can give birth to subsidiary, marry via a merger and die with a dissolution. It has to file it's own tax return, can be sued and has a set of rules that govern it's existence. Below are some of the points to consider when deciding whether to incorporate:

Employee vs. Self Employed: Criteria and Considerations

For the majority of income earners, employment status is pretty evident. If you are going to the same place every day, have an assigned cubicle with a computer and a corporate stapler, and you have a boss that tells you what you need to do, chances are you are an employee. Conversely if you have several clients, use your own laptop, and are worried about where your next sale is going to come from, you are probably self employed.

There are, however, some workers whose status is not that apparent. For example you may work from home and use your own computer, but you report to one entity, where someone supervises and directs your work. In these cases a determination needs to be made as to whether you are an employee or self employed. It is not enough for the person paying you to determine your classification ; often, payers are biased as they may not want to take on the financial costs and responsibilities of having an employee (explained below). As such, when in doubt about your status, it is helpful to answer the following questions:

The Importance of Breakeven Analysis for Business Owners

When embarking on your new business venture, one of the first and most important concepts that you will be introduced to is break-even analysis which, very simply, is the amount of revenues you need to generate to cover your direct and indirect expenses. A good grasp of this is essential for business owners since even businesses with significant sales revenues can incur losses if they are not able to cover their costs. While break even analysis tends to be used more for businesses that sell physical products, it can also help to the determine the price for services

24 Cost Effective Ways to Promote Your Small Business

After thinking long and hard you have decided that is time to launch your own business. You have a great product or service, you’ve come up with a compelling business name, all the paperwork has been filed and you have picked out the perfect location (or setup a snazzy new home office). All pieces are in place for your new independent life as a business owner. And then you realize that nobody except your spouse, family members and possibly your cat knows about your new venture. So, how do you bring your fabulous new product or service to your target market's attention? One way is to use the “build it and they will come” approach. This is usually not particularly effective (even Google, who historically launches products with little fanfare, could benefit from a little more marketing). The other, more effective approach is to get out there and promote your business. Of course in the initial stages, marketing budgets tend to be minuscule. On the other hand, many new business owners have time on their hands, while they wait to be deluged by orders. Below is a list of 24 cost effective ways to promote your small business:

Quebec Parental Benefits for Self Employed Workers

In Canada parental benefits are administered by Service Canada. Since they fall under the EI program, self employed workers must opt in tothe EI plan for self employed individuals to receive benefits. In Quebec however, unlike the rest of Canada (a common theme with Quebec), parental benefits are administered by the Quebec Parental Insurance Plan (QPIP), which does not specifically require opt in. Instead all workers in Quebec whether self employed or employees are required to pay premiums, based (similar to QPP) on their insurable earnings. For the self employed, premiums are payable at a rate of 0.86% upto maximum insurable earnings of $62,000, and are reflected in your annual tax return. As such all workers in Quebec are eligible for Parental Benefits.

It's Bad Business to Let the Killer Get Away With It: The Sam Spade Guide to Better Business

Sam Spade, the hard edged protagonist of The Maltese Falcon, is in some ways the quintessential small business owner. He is a private detective (or dick if you prefer) with an office, a partner, a secretary and a network that would make a social media climber swoon. As a small business owner he takes on the risks of running a business and enjoys the rewards. He sets his own prices which vary significantly depending on the client and the job. (Recovering the Maltese Falcon is worth thousands, while searching for someone’s sister is worth considerably less). And despite his womanizing and wayward ways, he also embodies qualities that would behoove business owners to emulate.

Invest in RRSPs or Repay your Mortgage?

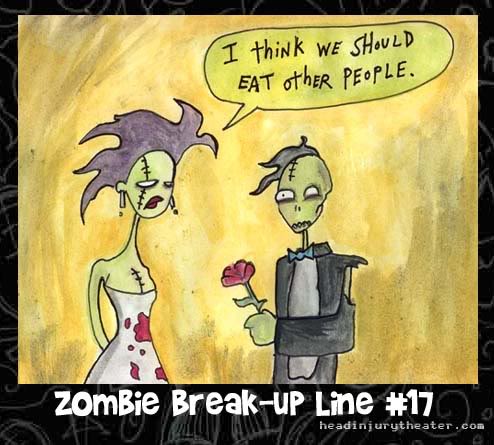

Breaking Up with a (Likeable) Client

Many of us have clients who are annoying, cheap, stupid , high maintenance or some combination thereof. As a new business owner, we are often stuck with these clients because we need them. However, we look forward to the day when we will have the thriving business that we so deserve, and fantasize about the spectacular way in which are going to fire them (you can shove your business into your rear orifice etc.) This is actually a productive fantasy as can help to channel and concentrate anger. Of course, in the majority of cases, a firing should be conducted with slightly less vigour.

Small Business Survival Statistics and 9 Steps to Improve Your Chances of Sticking Around

The temptation to start a small business or venture into self employment can be strong particularly for those who are unhappy with their existing employment situation. The freedom and flexibility that being your own boss seems to offer can be seductive, as is the potential for growth which you, as the business owner, can have full control over. You may have an idea or a particular skill that you believe is desirable to a specific target market and you are confident that once this target market is aware of your existence they will all be banging down your door. Consequently, you start your business by offering an amazing product or services, only to realize that building up a customer base is more challenging than you thought. Additionally, there are a number of other obstacles for which you do not have the expertise (done by another department when you were an employee) whether it is marketing, website development, legal research and accounting. Finally, you realize that you actually need a fairly sizable source of cash to maintain the business, deal with growth opportunities, whilst ensuring that you are able to support yourself.